Financial Sector Net Zero Initiatives Unite Under New Industry-Wide Alliance

Several leading financial industry alliances representing net zero ambitions for their respective sectors have joined together under the newly established Glasgow Financial Alliance for Net Zero (GFANZ). The coalitions under GFANZ include the Net Zero Asset Managers Initiative, the UN-convened Net-Zero Asset Owner Alliance, and the newly launched Net Zero Banking Alliance.

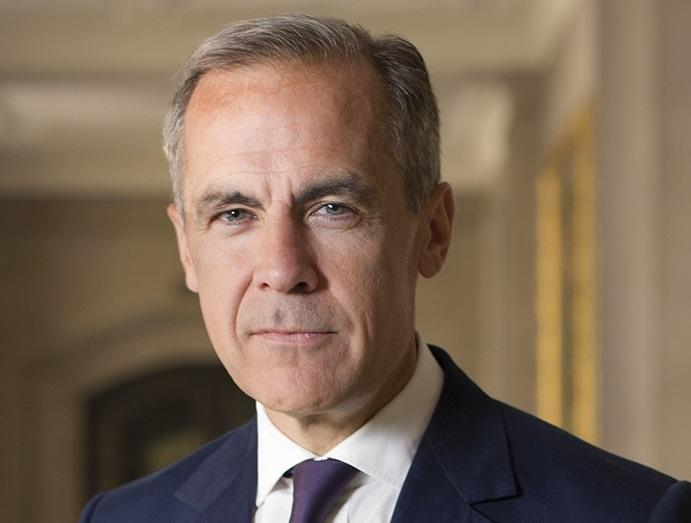

The launch of GFANZ was announced by UN Special Envoy for Climate Action and Finance and the UK Prime Minister’s Finance Advisor for COP26 Mark Carney, in partnership with the UNFCCC Climate Action Champions, the UN Race to Zero campaign, and the COP26 Presidency. Carney will chair the alliance.

GFANZ brings together more than 160 firms, responsible for assets of over $70 trillion, leading net zero initiatives across the financial system to accelerate the transition to net zero emissions by 2050 at the latest.

The Net Zero Asset Owners Alliance was founded in 2019, and now includes 37 institutional investors, including insurance companies and pension funds representing nearly $6 trillion in assets, uniting investor action to align portfolios with a 1.5 degree scenario, in alignment with the Paris Agreement.

The Net Zero Asset Managers initiative launched in December 2020 with a group of asset managers committing to support the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5°C. The initiative has rapidly grown, reaching 87 members managing $37 trillion in AUM.

The Net Zero Banking Alliance launched today, with 43 banks from 23 countries committed to align operational and attributable emissions from their portfolios with pathways to net-zero by 2050 or sooner.

By uniting the coalitions, GFANZ aims to mobilise the trillions of dollars necessary to build a global zero emissions economy and deliver the goals of the Paris Agreement. The umbrella organization will provide a forum for strategic coordination among the leadership of finance institutions from across the finance sector to accelerate the transition to a net zero economy.

Carney said:

“This is the breakthrough in mainstreaming climate finance the world needs. I welcome the leadership of the SMI Financial Services Task Force and other global banks for their new commitments to net zero and for joining forces with GFANZ, the gold standard for net zero commitments in the financial sector. Most fundamentally, GFANZ will act as the strategic forum to ensure the financial system works together to broaden, deepen, and accelerate the transition to a net zero economy.”