Sustainability Software Provider Pulsora Raises $20 Million

Enterprise sustainability management software company Pulsora, formerly PulsESG, announced today that it has raised $20 million in a Series A financing round, with proceeds support its global expansion and the growth of its platform enabling organizations to measure, report, and improve their sustainability and ESG initiatives.

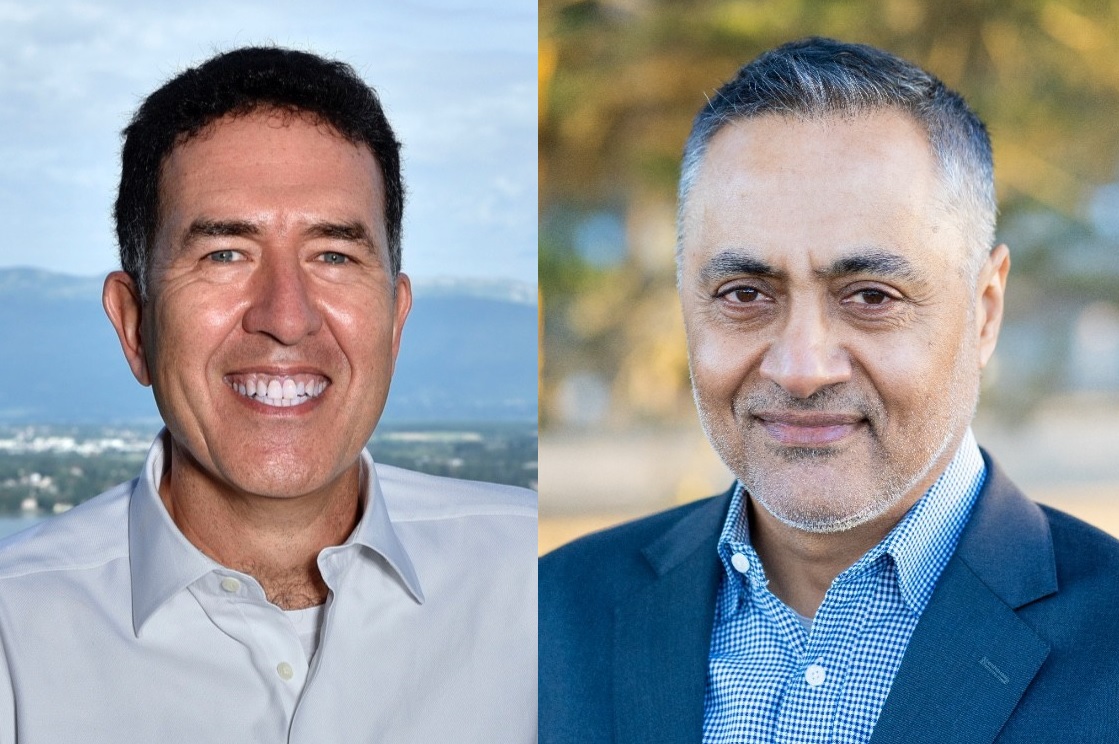

Pulsora was launched as PulsESG in 2021 by Silicon Valley software veterans Murat Sönmez and Inderjeet Singh, offering a software as a service (SaaS) platform utilizing internal data sources and external systems to help organizations define, measure and report on ESG performance, and address issues around ESG data quality and timelines. Last year, the company announced strategic investments from Workday and Accenture Ventures.

With the new funding, the company said that it aims to bolster its enterprise sustainability management platform with functionalities including carbon accounting, help ensure businesses can stay ahead of evolving sustainability regulations, and expand its footprint across North America, Europe, the Middle East, Australia, and Asia.

In a blog post on the company’s website, co-founders Sönmez and Singh said that Pulsora’s new name reflects its widened scope, “to be the software platform that’s the heartbeat of sustainability efforts across global enterprises.”

The Series A funding round was led by climate-focused investment firm Galvanize Climate Solutions, and included participation from Carica Sustainable Investments, Sabancı Climate Ventures, Aramco Ventures, and JetBlue Ventures, as well as existing investors FINTOP Capital, Builders VC, and SOMPO Holdings.

Saloni Multani, co-head of Innovation + Expansion at Galvanize Climate Solutions, said:

“As businesses grapple with an increasingly complex set of business risks, Pulsora emerges as an essential solution, offering timely, precise data for sustainability and ESG management. Our investment emphasizes our dedication to scaling innovations enabling the climate transition.”