Climate Accounting Platform Persefoni Raises $50 Million

Climate Management & Accounting Platform (CMAP) provider Persefoni announced that it has raised $50 million. The company also announced the launch of its AI-focused CMAP product, PersefoniGPT.

Launched in 2020, Persefoni’s SaaS platform enables companies and institutional investors to measure, analyze, plan, forecast, and report on their carbon footprint. The new Series C-1 funding round increases the capital raised by the company to over $150 million, including a $101 million Series B round in October 2021.

Kentaro Kawamori, CEO and Co-Founder of Persefoni said that the new investment will enable the company “to double down on our existing, successful AI developments.”

Kawamori added:

“When we founded the company in January 2020, we incorporated ‘Persefoni AI Inc.’ to cement our investment in AI technologies as being critical to our company ethos. We’re proud to have already delivered on that vision and are pleased to expand upon this early success with the step-change capabilities that generative AI represents.”

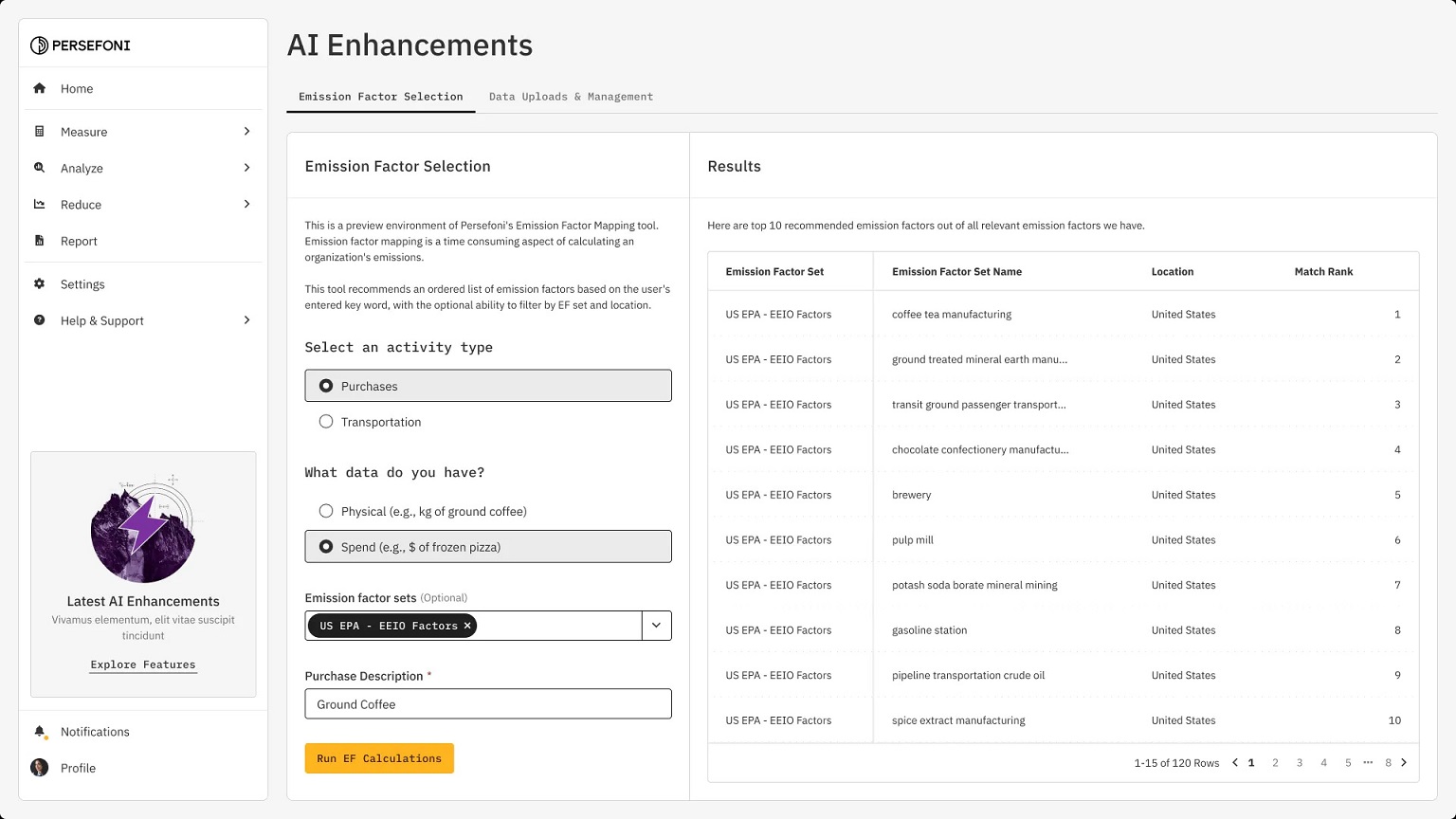

According to Persefoni, the launch of PersefoniGPT follows recent breakthroughs in AI transformer models, allowing expansion of the company’s AI portfolio model. The new GPT product is aimed at assisting users to become more efficient in their carbon accounting work, making it easier to perform functions including querying data, making calculation selections, learning how to use the platform, and receiving real-time support.

Kim Stroh, Head of AI and Co-Founder of Persefoni, said:

“Our early shift to invest in the transformative power of AI and machine learning technologies continues to pay dividends. Not only are we able to reduce costs, we’re propelling our solutions into a new model of efficiency and intelligence.”

The Series C-1 funding round was lead by TPG Rise, who also co-lead the Series B round, and included participation from investors including Clearvision Ventures, ENEOS Innovation Partners, NGP Energy Technology Partners, Prelude Ventures, Parkway Ventures, Rice Investment Group, Bain and Co., EDF, and Alumni Ventures.

Kawamori said:

“This Series C round represents a significant vote of confidence in our strategic vision, our product and sales execution, and our commitment to bringing best-in-class climate software solutions to our customers.”