Landmark Launches ESG Risk Management and Due Diligence Tool RiskHorizon

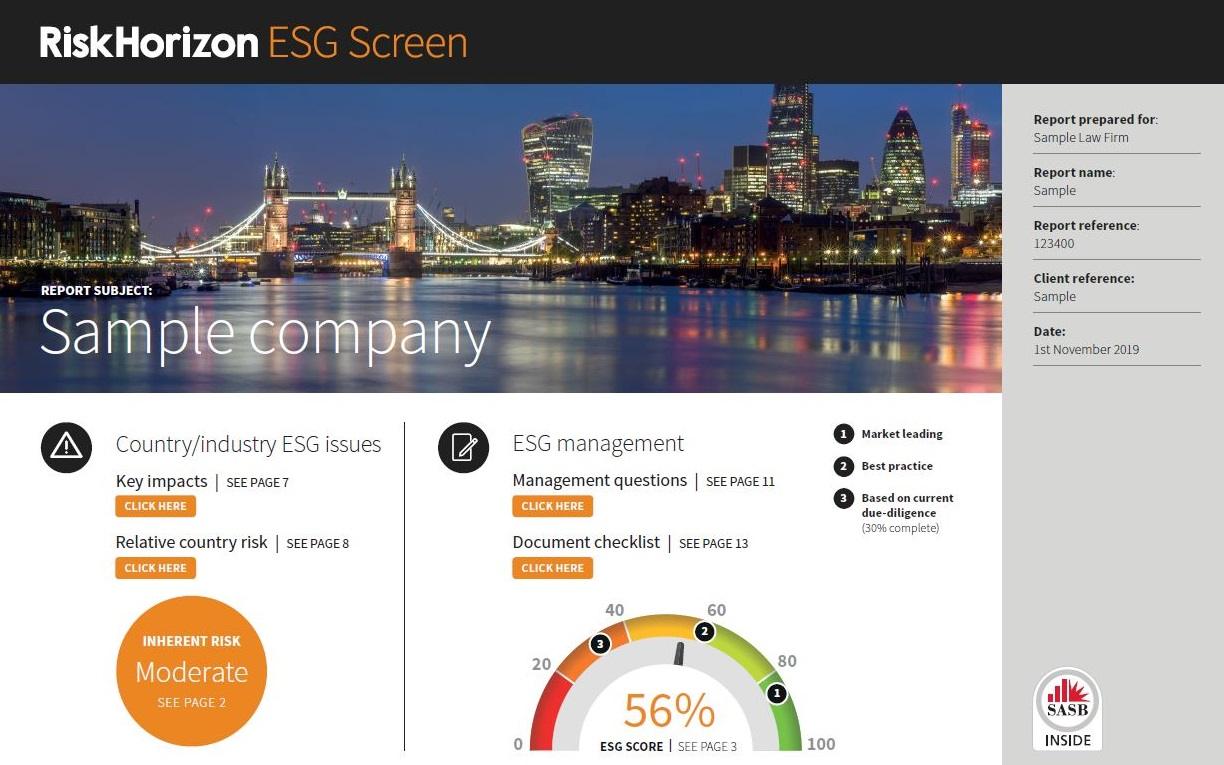

UK-based property market information provider Landmark Information announced today the launch of RiskHorizon, its new ESG management platform. The platform is designed to provide thorough and actionable global ESG due diligence of corporate investments and acquisitions to investors, property asset owners and managers and lawyers.

Landmark is launching the new product after acquiring the RiskHorizon ESG due diligence platform from global sustainability consultancy Anthesis Group in October. With the launch, Landmark stated that its proposition now includes a self-service software platform with an intuitive toolkit to screen, diligence, score and manage investment performance.

According to the firm, the RiskHorizon database spans 90 industries and more than 45 ESG risks in over 175 countries, assessing datasets from a host of authoritative sources including the World Bank, Unicef, the Global Child Forum, Freedom House, and United Nations Development Programme. Additionally, the platform has integrated the full breadth of the SASB (Sustainability Accounting Standards Board) Materiality Map to intelligently determine a wide range of relevant risks, by sector, including greenhouse gas emissions, biodiversity impacts, data security and customer privacy, diversity and inclusion, and bribery and corruption, among others.

Simon Boyle, Environmental Law Director of Landmark Information said:

“With C-suite executives, investors, supply chain managers and risk managers increasingly required to screen against Environmental, Social and Governance criteria, RiskHorizon significantly contributes to improving the performance of companies as well as managing portfolios, irrespective of their sectors or geography.

“Traditional environmental compliance is quickly evolving into the Environmental, Social and Governance space and those that do not engage with ESG will be left behind. With RiskHorizon, we provide the tools for risk management across law firms, private equity and corporate supply chains, enabling effective due diligence and ongoing ESG portfolio management.”