Institutional Investor Carbon Exposure Rises Even as Emissions Intensity Falls, State Street Study Reveals

The carbon emissions exposure of institutional investors globally rose significantly over the past year, with investors holding greater exposure to carbon-intensive sectors and company emissions rising year-over-year, even as carbon intensity – a measure of emissions per unit of portfolio company revenue – declined by double digits, according to a new study released by State Street, one of the world’s leading providers of financial services to institutional investors.

The study was based on the newly launched State Street S&P Global Institutional Investor Carbon Indicator, a new tool created in partnership with S&P Trucost, tracking the overall exposure of the portfolio holdings of institutional investors to carbon emissions, using aggregated and anonymized custodial holdings information from State Street’s $37 trillion in assets under custody and administration, and carbon emissions data powered by S&P Global Sustainble1.

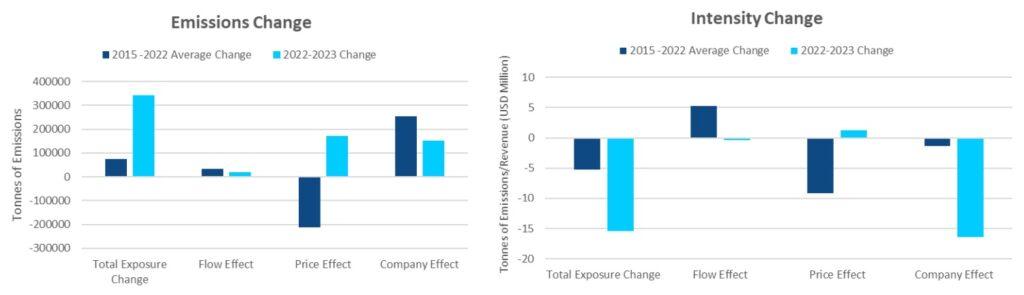

The new tool examines portfolio Emissions Exposure, measured as the tonnes of carbon emitted by portfolio companies and the weightings of those companies in the portfolios, as well as Intensity Exposure, or the tonnes of carbon emitted per million dollars of revenue. The report also provides insight into the drivers of changes in these metrics, broken down by “flow effects,” or purchase and sell decisions by portfolio managers, “company effects,” or the changes in emissions at the company level, and “price effects,” or the changes in company valuations that can impact weightings in portfolios.

The State Street report found that between March 2022 and March 2023, the emissions exposure of large investors, such as mutual funds, pensions and sovereign wealth funds, grew significantly rising nearly 9% in the year to 4.3 million metric tonnes, as post-COVID economic activity, and related emissions, increased, and as the relative valuations of carbon-intensive sectors such as Energy increased as well. While overall emissions grew, however, intensity measures fell, as revenue growth, particularly in carbon-intensive sectors, outpaced emissions growth.

By industry, the biggest drivers of these seemingly contradictory indicators were the carbon-intensive Energy, Materials, and Utilities sectors. The Energy sector had a particularly large impact on portfolio carbon exposure, driven by a combination of higher valuations resulting in larger portfolio weighting, and increased output – and emissions – with greater economic activity. Similarly, Materials and Utilities companies also saw emissions increase over the past year, with relative valuation growing as well. Despite the increase in emissions, each of these sectors reported lower carbon intensity, with growth in revenue outpacing growth in emissions.

By “effect,” the report revealed that the greatest driver of increased portfolio carbon exposure was the price effect, as valuations increased in carbon-intensive sectors, followed by the company effect as emissions grew with economic activity, while the impact of portfolio buys and sells were relatively minor. On the intensity front, the company effect drove nearly the entire change, as energy sector revenues rose significantly more than sector emissions.

State Street said that it intends to release its new investor Carbon Indicator annually.

Click here to access the report.